THE UK's rate of inflation has reached the highest rate in ten months as millions of households brace for a bill blow.

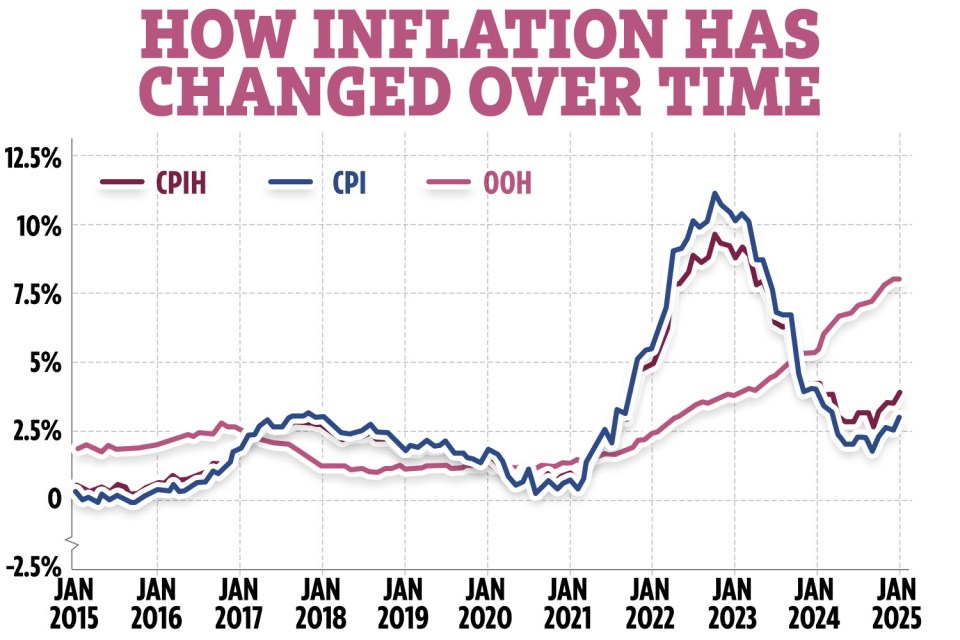

The Office for National Statistics (ONS) said the Consumer Price Index (CPI) measured 3% in the 12 months to January.

This was up 0.5 percentage points from December, when inflation sat at 2.5% and is the highest level in ten months.

Inflation is a measure of how the price of goods and services is rising or falling, which can affect people's household finances.

Today's figure is well above the Bank of England's 2% target and puts pressure on under-fire Chancellor Rachel Reeves.

Meanwhile, inflation is expected to hit 3.7% in the summer, driven by increases in the price of energy and food.

Read more on inflation

Grant Fitzner, chief economist at the ONS, said: "Inflation increased sharply this month to its highest annual rate since March last year.

"The rise was driven by air fares not falling as much as we usually see at this time of year, partly impacted by the timing of flights over Christmas and New Year."

He added that this was the weakest January dip since 2020.

Fitzner said the cost of food and drink added to the increase in inflation.

Most read in Money

"After falling this time last year, the cost of food and non-alcoholic drinks increased, particularly meat, bread and cereals.

"Private school fees were another factor, as new VAT rules meant prices rose nearly 13% this month."

The ONS's latest data also reveals core CPI inflation, which strips out energy, food, alcohol and tobacco, rose by 4.6% in the 12 months to January 2025, up from 4.2% in December 2024.

Chancellor Rachel Reeves said putting more money in people's pockets is her "number one mission".

She said: “Since the election we’ve seen year on year wages after inflation growing at their fastest rate – worth an extra £1,000 a year on average – but I know that millions of families are still struggling to make ends meet.

“That’s why we’re going further and faster to deliver economic growth.

"Growth is going nowhere fast"

By Jack Elsom, Chief Political Correspondent.

WHEN voters feel the cost of living starts to bite, politicians tend to get it in the neck.

So the unexpected jump in inflation is more than unhelpful for a government already facing public anger over various tax rises.

It presents two immediate problems for Rachel Reeves:

The first is that families’ trips to the shops are getting more expensive, especially given the spike was driven by increased food prices.

It also means the Bank of England is now less likely to cut interest rates, meaning mortgage costs could remain higher for longer.

Both will take a direct strain on the finances of millions of Brits trying to make ends meet - many of whom will have voted Labour last July on the promise of an easier ride.

Ms Reeves will be all too aware of the political danger rising inflation can inflict: just ask the Tories who took the blame for soaring prices in the wake of Russia’s invasion.

Throw this in with next-to-no growth, and some critics are even starting to murmur about “stagflation” - the toxic combination of a flatlining economy and rising inflation.

Taxes are rising, inflation is rising, cuts are on the way, and growth is going nowhere fast.

The only thing growing at speed is the country’s eye-watering benefits bill - set to hit £100billion for sickness payments alone by 2030.

The Government spin machine is out in full force softening the blow: Ms Reeves herself legitimately pointing to rising wages outstripping inflation.

But in the cut and thrust of politics - when so much is also about one’s perceived competency - having highest inflation in 10 months is only ever a bad thing.

"By taking on the blockers to get Britain building again, investing to rebuild our roads, rail and energy infrastructure and ripping up unnecessary regulation, we will kickstart growth, secure well-paid jobs and get more pounds in pockets.”

What it means for your money

The news will come as a blow to millions of households who will see their broadband and mobile bills rise in April.

Fraser Kerr, regional director Scotland & head of financial consultants at abrdn, said: "Inflation rising isn’t what anyone wanted, particularly after a period where it appeared to be stabilising.

"This will bring more pain for households that are already under pressure to keep spending under control. Higher inflation means higher prices."

Rising inflation is bad for households as it means their everyday spending power is eroded.

For example, if it rises it means the cost of your weekly shop has increased.

Why does inflation matter?

INFLATION is a measure of the cost of living. It looks at how much the price of goods, such as food or televisions, and services, such as haircuts or train tickets, has changed over time.

Usually people measure inflation by comparing the cost of things today with how much they cost a year ago. The average increase in prices is known as the inflation rate.

The government sets an inflation target of 2%.

If inflation is too high or it moves around a lot, the Bank of England says it is hard for businesses to set the right prices and for people to plan their spending.

High inflation rates also means people are having to spend more, while savings are likely to be eroded as the cost of goods is more than the interest we're earning.

Low inflation, on the other hand, means lower prices and a greater likelihood of interest rates on savings beating the inflation rate.

But if inflation is too low some people may put off spending because they expect prices to fall. And if everybody reduced their spending then companies could fail and people might lose their jobs.

See our UK inflation guide and our Is low inflation good? guide for more information.

As inflation has risen it means the cost of living is still increasing at a faster pace than before - which is bad news for your budget.

Alice Haine, personal finance analyst at Bestinvest, said: "An uptick in the headline inflation figure will certainly be worrying for households who may be fearing a return to the dark days of rapid price rises that devastated household budgets during the cost-of-living crisis.

"Household budgets are already set for a heavy hit in April when household bills such as energy, water and council tax jump up again.

"For retirees on fixed incomes, who have also been hit by the Government’s decision to scrap winter fuel payments for all but the poorest pensioners, times may feel very tough."

Mobile and broadband bills

January's inflation is particularly important as several broadband and mobile firms use it to decide how much to increase contracts by every April.

Virgin Media and O2 hikes its prices by January's RPI plus 3.9%

The annual RPI inflation rate was 3.6% in January 2025.

Virgin Media broadband customers who took out their contract before January 9, 2025 will be paying £26 a year more for their deal, according to Uswitch.

Meanwhile, O2 mobile phone customers will receive a flat fee increase of £1.80.

Customers who sign up for a new contract after January 9 will be told the amount their bill will increase in pounds and pence under new Ofcom rules.

Ernest Doku, telecoms expert at Uswitch.com said: "If you’re one of the estimated eight million Virgin Media O2 customers who are out of contract or coming to the end of your existing mobile or broadband deal, you don’t need to put up with price rises.

“You don't have to let price hikes slide - it only takes a few minutes to run a comparison and see what other options are out there.”

Other customers will see their bills increase based on the December measure of CPI.

BT, EE, TalkTalk and Three all use the December figure to calculate how much to push up customers' bills.

Most broadband and mobile customers are still on contracts with annual price rises linked to inflation.

It is estimated that customers on inflation-lined contracts will likely pay out an estimated total of £64million more on their broadband and mobiles per month from April.

In real terms bills are set to increase by an average of £21.99 per year for broadband and £15.90 a year on average for mobiles.

Mortgage holders and savers

Higher inflation can spell bad news for mortgage holders as it can cause the Bank of England to hold interest rates.

This could mean that mortgage rates stay higher for longer than expected.

The Bank of England recently chose to cut its Base Rate from 4.75% to 4.5% on February 6.

It is expected to cut interest rates a further three times this year, which could leave interest rates at around 3.75% by the end of December.

How you can find the best savings rates

If you are trying to find the best savings rate there are websites you can use that can show you the best rates available.

Doing some research on websites such as MoneyFacts and price comparison sites including Compare the Market and Go Compare will quickly show you what's out there.

These websites let you tailor your searches to an account type that suits you.

There are three types of savings accounts fixed, easy access, and regular saver.

A fixed-rate savings account offers some of the highest interest rates but comes at the cost of being unable to withdraw your cash within the agreed term.

This means that your money is locked in, so even if interest rates increase you are unable to move your money and switch to a better account.

Some providers give the option to withdraw but it comes with a hefty fee.

An easy-access account does what it says on the tin and usually allow unlimited cash withdrawals.

These accounts do tend to come with lower returns but are a good option if you want the freedom to move your money without being charged a penalty fee.

Lastly is a regular saver account, these accounts generate decent returns but only on the basis that you pay a set amount in each month.

Higher inflation could spell bad news for savers as it may eat into their returns.

Higher inflation may slow the disappearance of the top savings rates, but it may eat into the amount of interest they earn.

Although the best savings deals are beating inflation for now, higher inflation and lower savings rates may give savers a worse than anticipated return.

Dean Butler, Managing Director for Retail Direct at Standard Life, said: "For savers, an extended period of elevated rates provides an opportunity.

"Easy-access cash savings deals at or just below 5% remain available, but as inflation picks up it will more aggressively erode real returns. Shopping around for the best rates remains crucial."

Standard Life analysis shows that with inflation at 3% someone with £10,000 in savings who secured a 5% interest rate could see their savings be worth £10,373 in real terms after two years.

In contrast, someone settling for a 3% deal would see the value of their savings fall to £9,982 over the same period.