Mortgage repayments rise for homeowners as Bank of England increase interest rates from 0.25 to 0.5 per cent

The increased rate is the first in over a decade and will see thousands of Brits with variable rate mortgages have to fork out for higher monthly payments

THE Bank of England doubled interest rates yesterday and lenders put up mortgage repayments within minutes.

The base rate rise from 0.25 per cent to 0.5 was the first in ten years.

It came as a shock to eight million people who bought homes after July 2007. They had never experienced a rate increase before.

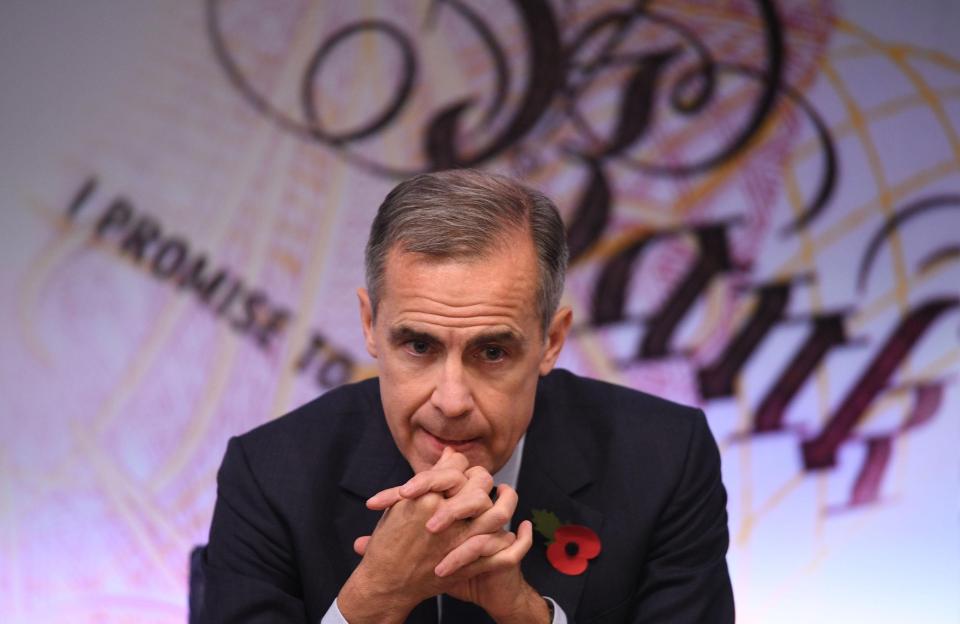

Bank of England boss Mark Carney warned of further rises, blaming the battle to stem inflation and boost the economy. He signalled two more are likely in the next three years.

Mr Carney said “savvy” households with fixed-rate mortgages would feel no immediate pain as yesterday’s rise will take time to filter through.

But RBS, NatWest and Nationwide were among those who rushed to raise the rate on other mortgages.

Share it, says PM

THERESA May demanded banks reward savers after the rise.

Downing Street said banks should not use the increase in borrowing costs to punish customers with higher fees and boost profits.

The PM’s official spokesman said: “Following the rise we would expect to see higher interest rates passed on to savers.”

A 0.25 per cent increase will see the typical home loan repayment of £487 a month go up by £6.40.

House buyers with a £100,000 mortgage will have to find £13 a month extra, according to the Building Societies Association.

Its chief Robin Fieth said: “Rates remain very low and the impact on household budgets is not likely to be immediately significant for most.”

Deal? or no deal?

THOSE on a fixed rate mortgage will see no increase, but may pay more as their deal ends.

If you are looking to buy a property or remortgage it might be worth looking at a fixed deal to guard against future predicted hikes.

Renters may face rises, but only after contracts are renewed.

Lloyds, Barclays and Halifax did not raise savings rates despite increasing tracker and variable mortgage costs.

Lloyds also ruled out an increase for 22million current account customers.

Think tank the Resolution Foundation said younger families will be hit most since the size of their mortgages are “far bigger than for older cohorts”.