Brit tourists around the world refused cash after Brexit sparked sterling fears

Banks won't let Brits turn their pounds into local currency as there has been no official exchange rate set since Brexit

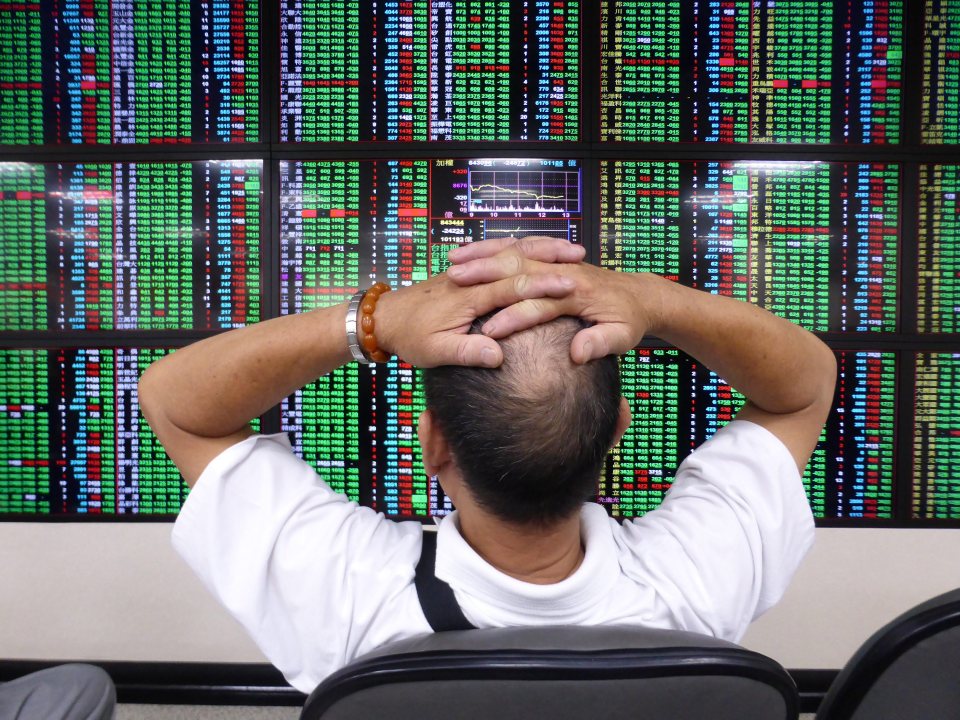

BRITISH tourists around the world are being left penniless because of the instability of the pound.

Cash-strapped holidaymakers are in a state of panic as local banks and ATMs in Greece, Australia and Hawaii have refused to exchange their money.

The shocking events come after £100 billion was wiped off the FTSE 100 after Britain voted to leave the EU.

The pound lost around 20 per cent of its value after it had been confirmed that the Leave campaign had won.

In Greece, tourists were told that there was no official exchange rate for the British pound.

Jet setter Matt Rooney tweeted from the island of Kos, saying: “It's beginning already! We're in Greece, no cash exchange & no cash machine withdrawals for Brits. Great #brexitfail.”

The irate tourist tweeted a picture of a sign which read: “We would like to inform you that we cannot exchange British or Scottish pounds at the moment, as we do not have an official exchange rate from the central bank.”

He later sent an update saying that the situation was improving.

He tweeted: “Am told cash machines now firing on all cylinders, but still no sterling cash exchange at the hotel.”

Have you been affected by the panic? Please contact Fionn Hargreaves at [email protected]

Related Stories

The Commonwealth Bank and NAB in Australia also suspended the exchange of British pounds until the start of next week.

Commbank tweeted: “We are sorry but due to recent results from the British exit referendum we are temporarily suspending all foreign exchange of GBP pounds and transactions that do not include AUD until the morning of Monday, 27 June.”

According to MailOnline, tourists in Hawaii could not withdraw cash because of an “unrecognised exchange rate” for sterling.

The “pound panic” started when 52 per cent of Brits voted to leave the EU.

The referendum revealed massive divides in the country, with Scotland, Northern Ireland and London all voting to remain.

As soon as Sunderland announced a huge Leave majority, the value of the pound plummeted by three per cent.

But the pound fought back when Wandsworth announced a large victory for Remain.

The crash was worse than the Winter of Discontent in 1978, Black Wenesday on 1992 and the day the Lehman brothers shut in 2009.

Britain is now expected to lose her AAA credit rating and is only the sixth biggest economy in the world.

Bank of England Mark Carney said: Governor Mark Carney said: “Some market and economic volatility can be expected as this process unfolds.

“As a backstop, and to support the functioning of markets, the Bank of England stands ready to provide more than £250 billion of additional funds through its normal facilities.”